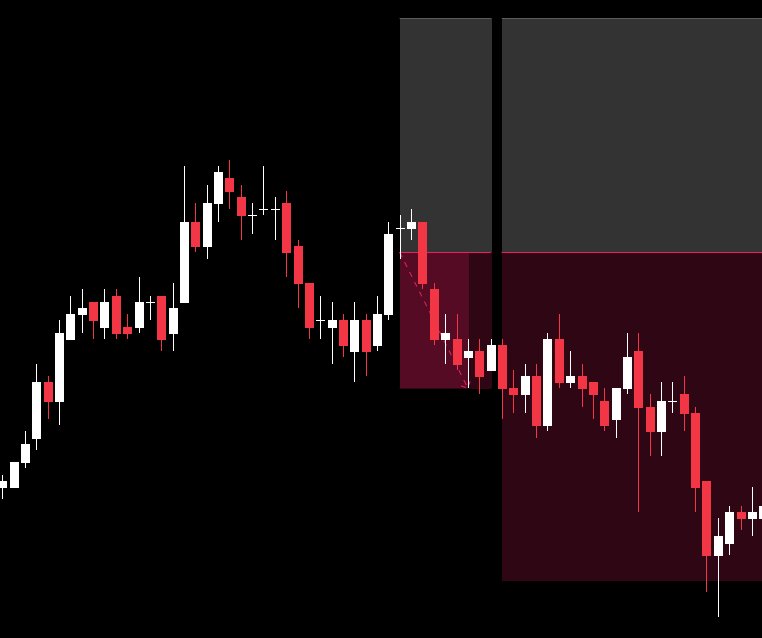

It happens to everyone, you see a setup that looks almost right, but not perfect. You hesitate, afraid of missing the move, and end up entering anyway. To feel safer, you give the trade a little more “room to breathe.” You move your stop lower, thinking you’ll avoid being wicked out. But deep down, you know what that means: you didn’t get a good entry.

→The way i see it, a wide stop is almost always a symptom of a bad entry.

The Illusion of Safety

Giving a trade “room to breathe” sounds good, in practice though it’s often a way to hide uncertainty. Fact is you’re not protecting the trade you’re just increasing your exposure. If your entry is off, it doesn’t matter how much space you give it, price will still find your stop. You might get lucky a few times when momentum saves you, but wide stops slowly destroy consistency. Also if you trade with a RR (risk reward) ratio that makes your targets too hard to reach.

Stop Using Liquidation level instead of SL

I’ve seen traders rely on liquidation instead of using a stop loss, and that’s just straight up reckless and as wide as it gets. Price doesn’t move in straight lines it moves up, down, and back again. So yes of course, price will eventually go up at some point and down at another. That doesn’t prove your setup worked it only shows you held long enough to get lucky.

How to place Stop Loss

Swing based stop loss

A simple method is to place SL just bellow the last swing for long positions and above the last swing for short. That point represents structural invalidation if price breaks it, the setup has likely failed. If that level forces your stop to be 5–6% away or more, the problem isn’t your stop it’s your entry. You’re probably too early or chasing price.

Instead of forcing a wide stop, wait for a cleaner setup closer to structure or use the next method to place your stop loss.

ATR based stop loss

Another solid approach is to base your stop using the ATR (average true range). ATR measures how much an asset typically moves per candle, helping you avoid stops that are too tight during volatile conditions.

A simple rule

Set your stop 1.5–2× the current ATR away from your entry. Let’s assume we enter a long position at 1.30, and the ATR (14) on 1h chart is $0.0017 and we decide to use the 1.5x.

- Entry : 1.30

- ATR : 0.017

- SL = 1.5 X 0.017 = 0.0255

- Place stop loss at 1.30 – 0.0255 = 1.2745 (1.96%)

With a 800 USDT trade at 10x that is around 157 USDT loss (19.6%). If this SL was a 5% (50%) hit then it would be 400 USDT

Bellow is a simple script for Trading View so you can visualize ATR stop loss on chart. Script plots 2 labels one above and one bellow live price indicating where your stop loss should be according to ATR. From options you can change the length and multiplier.

//@version=6

indicator("Live ATR Stop Loss Helper", overlay=true)

// === Inputs ===

atrLength = input.int(14, "ATR Length")

multiplier = input.float(1.5, "ATR Multiplier")

// === Calculations ===

atrValue = ta.atr(atrLength)

livePrice = close

longStop = livePrice - atrValue * multiplier

shortStop = livePrice + atrValue * multiplier

longPct = ((livePrice - longStop) / livePrice) * 100

shortPct = ((shortStop - livePrice) / livePrice) * 100

// === Labels ===

if barstate.islast

label.new(bar_index, longStop,text = "SL ↓ " + str.tostring(longStop, format.mintick) + " (" + str.tostring(longPct, "#.##") + "%)", style = label.style_label_left, color = color.new(#e6da34, 80), textcolor = color.white, size = size.small)

label.new(bar_index, shortStop, text = "SL ↑ " + str.tostring(shortStop, format.mintick) + " (" + str.tostring(shortPct, "#.##") + "%)", style = label.style_label_left, color = color.new(#e6da34, 80), textcolor = color.white, size = size.small)In simple words :

→ If You’re Afraid of the Pullback, You’re Too Early. If you’re worried that price might move too far against your entry, you should wait.

→ If volatility scares you, trade stocks or something slower.

Use a stop loss not because you fear the price might go against you, but because you understand that you can’t always read market sentiment or indicators perfectly, basically, you can’t always be right.