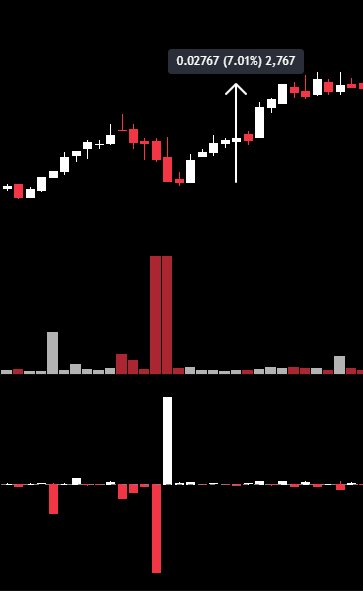

One of the most deceptive phenomena in crypto trading is when price moves up or down with almost no volume. You’ve seen it, you’ve probably traded it and maybe you lost money on it. But once you understand how it works you’ll never look at a green candle the same way again.

Price moves, but nobody is buying

Imagine you’re watching a coin. Price was at $0.40, then suddenly it’s $0.43. You check and the volume barely moved, delta is flat same is OBV. There are no real buyers so how did price jump 7.5%?

Price doesn’t need volume to move, it needs space.

In a thin order book, there arent many limit orders stacked at each price level. That means even a small market order can jump several levels if there’s no liquidity in between. Price moves not because of demand, but because there’s nothing in the way.

Lets look at the numbers

Lets make a simplified example with round numbers. Assume current price at $0.40 and order book looks like this :

| Price | Quantity (Sell orders) |

|---|---|

| $0.41 | 40 coins |

| $0.42 | 100 coins |

| $0.43 | 50 coins |

| $0.44 | 30 coins |

| $0.45 | 20 coins |

Now you place a market buy order for 150 coins. This is what happens:

- Your order eats the 40 coins at $0.41

- Then the 100 coins at $0.42

- 10 coins from the 50 at $0.43

- Your order is filled and the last trade was $0.43

- Price jumps from $0.40 to $0.43 and only 150 coins were traded.

That’s almost 7.3% move on almost no volume.

Baiting sentiment

Now imagine this happening live. The coin is dumping suddenly the price floats up 5–7% with tiny orders → Retail sees green candles, they think reversal → Traders enter long → Shorts get squeezed → Funding flips → Sentiment resets

This is the Ghost Bounce Trap price moves up, conviction stays dead, and traders get baited into chasing a mirage.

What happens next?

After price floats up and traders start buying, a trader with size drops a sell wall sometimes spread across multiple price levels. It absorbs all the new buys, stalls the price, and then pulls the rug. Now you see delta dropping and volume rising red, price drops fast. Traders who bought the bounce get trapped.

This is a short trap followed buy a long trap, engineered with tiny buys and a thin order book.

It’s easy to think that “price move = strength” but in thin order books price is just a number. It doesn’t mean people are buying, it just means someone placed a market order and there weren’t many sell orders in the way.

So before you buy a breakout, check:

- Is volume increasing?

- Is delta positive?

- Is OBV rising?

- Is the order book thick?

If the answer is no, it might be a trap.

Thin order books let price move quickly, even when there’s not much volume. In low liquidity conditions, small trades can cause big shifts, and that can confuse traders who expect volume to lead the way.

Gaps between candles

You can also tell when liquidity is low by looking at the gaps between candles, if price jumps from one level to another without trading in between, thats usually a sign the book was thin and couldn’t absorb the move.

Stop loss slipage

Another problem caused by a thin order book is stop loss slippage. For example, lets say you set your SL at -3% from your entry price, and you’re in with 5,000 coins. -3% from 0.40 is 0.388. Since SL is a market order, when it triggers, it fills at whatever price is available. Your 5,000 coins might start filling at 0.388 but end up completing at 0.38 — which is almost a 7% loss. That kind of slippage can lead to unexpected losses, or even liquidation, especially if you re trading with leverage and your liquidation level is close.

| Price | Available liquidity | Fill status |

|---|---|---|

| 0.388 | 550 coins | Partial fill |

| 0.386 | 1000 coins | Partial fill |

| 0.384 | 1500 coins | Partial fill |

| 0.382 | 700 coins | Partial fill |

| 0.380 | 1250 coins | Final fill |

Total coins sold: 5,000

Expected SL price: 0.388 (−3%)

Actual average fill price: ~0.382

Effective loss: ~4.5% instead of 3%

When the order book is thin price doesn’t behave the way most traders expect. It can jump through levels with barely any volume, stop-losses can slip far beyond their intended mark and what looks like a clean bounce can turn into a trap in seconds.