What is Funding Rate

Funding rate is a periodic payment between long and short traders in perpetual futures contracts it is deisgned to keep the futures price aligned with the spot price. Funding payments are usually every 8, 4 or even 1 hours but this is something you can see in your exchange next to the percentage.

It’s not a fee from the exchange, it’s a p2p balancing mechanish.

When the countdown ends if funding rate is positive Longs will pay short if it’s negative Shorts will pay Longs.

Possitive funding rate → Longs pay shorts → Market is bullish, longs are dominant.

Negative funding rate → Shorts pay longs → Market is bearish, shorts are dominant.

Think of it like that, a coin has two prices the real price which is Spot price and Perp price which allows leverage.

- Spot Price (No leverage, no funding)

- The actual market price of the coin, determined by real time buying and selling on exchanges.

- Perpetual Price (Allows leverage)

- The price of a derivative contract that mimics spot.

How these two prices interact? When perp price rises above spot, funding turns positice and longs pay short. When price drops below spot, funding turns negative and shorts pay longs.

How much does one side pay the other? Here is an example:

- You enter long with 1000 USDT and x10 leverage. That equals a position of 10,000 USDT.

- Funding rate is -0.14%.

- Funding payment will be 10,000 x 0.0014 = 14 USDT.

- If you re still holding that Long position when countdown ends you ll receive 14 USDT to your margin position.

What someone would expect is the obvious.

- Positive funding → price should go up

- Negative funding → price should go down

But in reality funding rate reflects sentiment, not price direction. When sentiment becomes extreme, the market often does the oposite.

Here is where it gets interesting

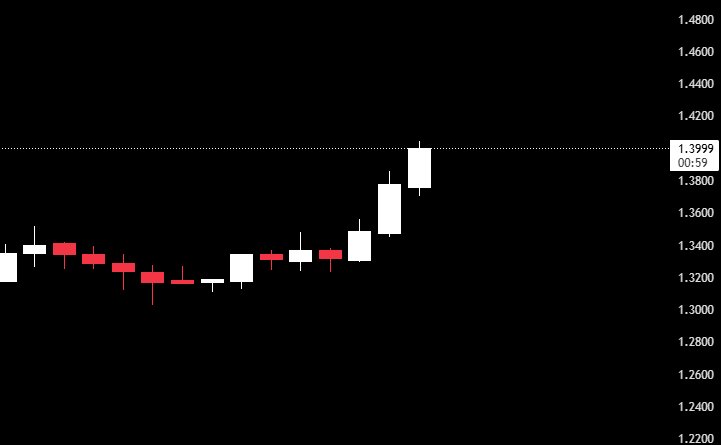

Funding rate above or bellow 0.05% is considered high, for more volatile coins you can increase that to 0.10%. Look at this KAITO example.

This is 5 min chart, KAITO is pumping.

Funding rate is at extremes -0.8553%

4 mins later it got even lower to -1.1147%

If shorts are so aggresive why the price doesn’t drop? Because extreme negative funding rate means everyone is short and market loves to punish overcrowded trades.

- Overcrowded shorts = Squeeze fuel → If price stabilizes or rise even slightly, these shorts start to panic, they buy back, price pumps harder.

- As price rises short positions hit their liquidation thresholds → Each liquidation is a market buy → price rises → more liquidation

This is exactly the recipe for a short squeeze, a violent upward move fueled by forced exits.

Price has reached 1.4225

Funding is at -1.4084%

The past 60 mins approximately 220k shorts liquidated in KAITO.

Market makers enter the game

There are 4 ways MMs benefit from founding rate

- Farming the imbalance

- They hold balanced positions (e.g. long spot, short perp). When funding is positive they collect payments from longs holding shorts. When funding is negative they flip.

- Inventory managment

- Fuding rate helps them decide where to hold exposure.

- Squeeze exploitation

- When shorts overcrowd and funding goes deeply negative they may accumulate long positions and push price up to trigger iquidations. That way they profit both from funding and price move

- Cross exchange arbitrage

- They operate across multiple exchanges. If funding differs between them they open hedged positions to collect spread. Long on one short on another, funding rate difference = profit

What to do

If funding is at extremes avoid trading, if you feal like going into, don’t go with the masses if they are betting against the move. They are like sheeps going for slaughter.