Liquidity hunts are part of the crypto ecosystem.

Every trader knows that feeling when you spot the perfect setup, everything lines up momentum looks great and your stop loss is safely below structure. Then, out of nowhere, the price dips just enough to hit your stop before shooting back in the direction you expected. It feels personal, like the market hunted you on purpose but it’s not, that is just how liquidity works.

In crypto, price doesn’t move at random. It moves to find liquidity the stop losses, limit orders, and trapped traders sitting at obvious levels. That’s what fuels every big move. And in smaller MC coins where even a few large orders can move the chart, these liquidity hunts happen faster and hit harder.

What Liquidity Hunts Really Are

A liquidity hunt (or stop hunt, liquidity sweep, whatever you call it) happens when price briefly breaks above a recent high or below a recent low, triggering stops and trapping traders in the wrong direction. Once that liquidity is taken the market often reverses hard.

For example, imagine a coin trading around 0.043, then drifting down to 0.040 and holding there for a few hours. You check the OBV and RSI, both slowly going higher a clear sign of hidden strength. You start thinking, “This thing’s about to move up.” You wait a bit longer price dips once more to 0.0390, and you finally enter, setting your SL just below the previous low at 0.0376.

For a moment, everything looks calm. Price holds steady for a couple of candles. Then volatility kicks in ATR spikes, and suddenly price wicks below 0.0376, taking out your stop. Within minutes, it reverses sharply, rallies to 0.044, pulls back to 0.042, and then prints three strong green candles straight to 0.046.

You were right but too early. The market hunted your liquidity before making the move you expected.

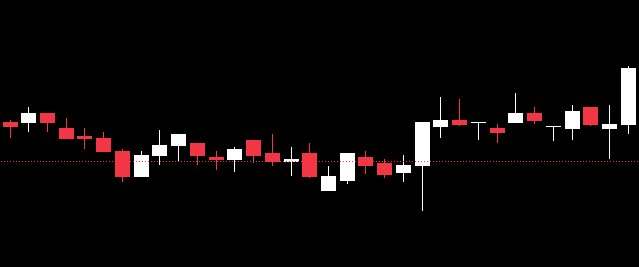

Same example in the steps market made.

- Market builds liquidity

- When price drops from 0.043 → 0.040 → 0.039, many traders start looking for a reversal. They place long entries near the bottom, with stop-losses just below the previous low (in your case, around 0.0376). At the same time, breakout traders set short orders below 0.0376, expecting continuation if that low breaks. So under that level, there’s a pool of liquidity, a mix of stop-loss sell orders from longs, and short entry sell orders from breakout traders.

- Market hunts the stops

- When ATR spikes, that’s volatility often triggered by big players or algorithms. Price dips below 0.0376, not because fundamentals changed, but because the market wants to trigger those stops and fill buy orders for larger players who want to go long. That drop forces SLs that become market sell orders providing the liquidity needed for big buyers to fill their positions.

- Reversal after the sweep

- Once liquidity is collected the market reverses sharply. Price rallies back above 0.040, confirming that the low wasn’t real weakness it was a liquidity grab. Then momentum accelerates as some trapped shorts create market buy orders by hitting SLs pushing price up to 0.044 → 0.046.

Liquidity hunts aren’t market manipulation or bad luck they’re simply how the game is played. Every big move starts with a cleanup, a reset of the order book where price sweeps through obvious highs and lows to collect the liquidity it needs to move. It’s not personal it’s mechanical.

Next time price takes your stop and then rockets in your direction, don’t get emotional. Mark the level, study the structure, and learn from it. Because every liquidity hunt tells a story and when you start to see it clearly, you’ll stop being the liquidity and start trading like the ones who hunt it.